20VC Special: The Real Estate Fintech OGs on Why This Is Not The End For The Bay Area and What Can Be Done To Solve It, The Pros and Cons of Working with Corporate Investors and How Leading Their Teams Has Fundamentally Changed in a COVID World

20VC

Feb 17, 2021

Posted by

In today’s episode focused on real estate fintech we are joined by Assaf Wand, Nima Ghamsari, Max Simkoff and Brendan Wallace.

Assaf Wand is the Founder & CEO @ Hippo Insurance, with over $700M in funding Hippo are setting a new standard for home insurance and offer protection for what’s important to today’s homeowner.

Nima Ghamsari is the Founder & CEO @ Blend, with over $665M in funding they are the digital platform streamlining the journey from application to close — for every banking product.

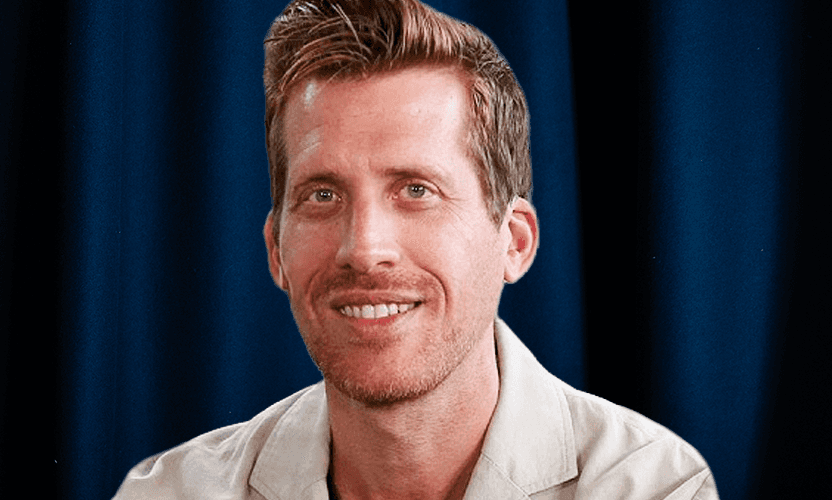

Max Simkoff is the Founder & CEO at States Title, with $229M in funding States Title are using machine intelligence to create a vastly more simple and efficient closing experience for lenders, real estate professionals, and homebuyers.

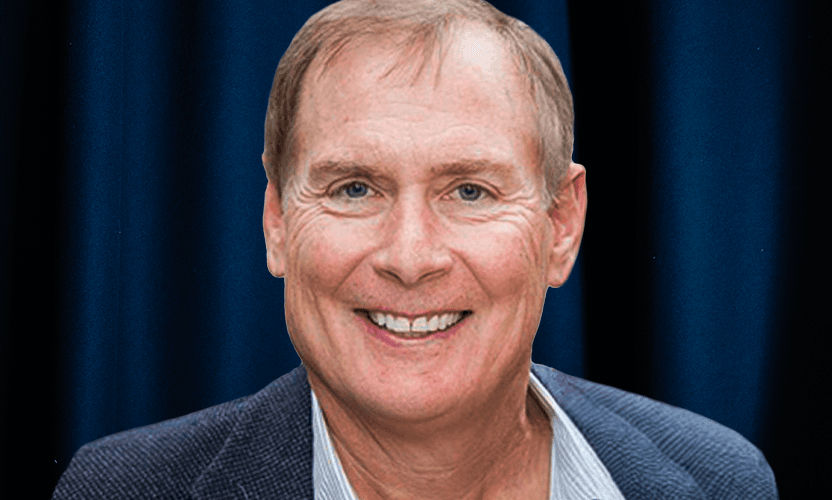

Brendan Wallace , Co-Founder and Managing Partner at Fifth Wall, with over $1.3Bn in commitments and AUM across multiple different vehicles, they are the largest venture firm focused on the real estate industry and property technology for the Built World.

In Today’s Episode on Real Estate Fintech You Will Learn:

1.) 3 of the largest and most successful founders in the financial real estate market, what have been their biggest learnings from their friendship over the last 5 years? What hot topics do they debate most as a group? How did their opinions and views change as a result?

2.) How do they think and feel about the tech exodus from Silicon Valley, temoorary movement due to COVID or fundamental shift? How closely correlated is the move out of California with the explosion of liquidity from IPOs and acquisitions? What pisses Max off most about people leaving CA currently?

3.) How have their roles as leaders changed in the time of COVID? What have been the most challenging elements? What have they had to embrace? Have they had to disregard or stop? What advice do they give to other founders scaling into hyper-growth in a remote format?

4.) What do they believe is their fundraising strategy that allowed them to raise over $1.5Bn as a group? How do they think about what they look for in each stage of investors? How does it change when entering growth stages? Has their experience been having corporates play a large role in their financing? What are the biggest challenges of working with corporates? What does one need to do to extract the most value from them?

Want the latest 20VC insights?Get all of the insights from of our latest epsiodes and more in our monthly newsletter. All venture, no spam.

Item’s Mentioned In Today’s Episode

Max’s Favourite Book: A Heartbreaking Work of Staggering Genius

As always you can follow Harry and The Twenty Minute VC on Twitter here!

Likewise, you can follow Harry on Instagram here for mojito madness and all things 20VC.

Share this post

Link copied